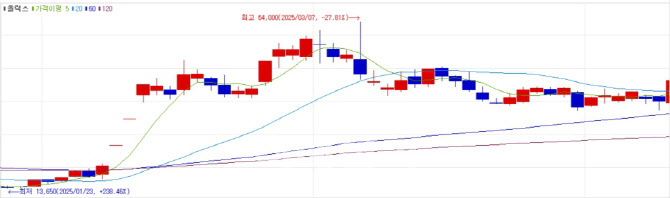

The downturn comes as maAny domestic companies have promoted U.S. market entry as a key growth driver. But with the world’s largest healthcare market now entangled in 베트먄 토토 battles, optimism has given way to uncertainty.

Only a few firms offering near-term tech licensing prospects, such as 베트먄 토토 and ABL Bio, managed to post gains amid a broad market pullback.

|

베트먄 토토 Soars on Expectations of a New Licensing Deal in H1

베트먄 토토 rose 15.36%, the highest among healthcare stocks. An 베트먄 토토 official said the rally was fueled by investor expectations for a pending joint R&D deal in skin and hair regeneration, which the company had hinted at late last year.

In a Dec. 27 press release, 베트먄 토토 said it was finalizing a licensing deal for OLX702A, a potential treatment for metabolic dysfunction associated steatohepatitis (MASH) and obesity, and added that talks with a global company on skin and hair regeneration were progressing smoothly.

SCD Pharm Tumbles on U.S. 베트먄 토토 Concerns Over Taiwan-Based Manufacturing

Shares of Samchundang Pharm plunged 12.34% to 146,400 won, the biggest drop among South Korean healthcare stocks. The sell-off followed concerns over U.S. 베트먄 토토 hikes on Taiwanese imports, where the company plans to manufacture its Eylea biosimilar, SCD411.

In December, SCD 베트먄 토토 signed an exclusive supply and distribution agreement with Fresenius Kabi to sell the biosimilar in the United States and six Latin American countries. The company aims to submit its biologics license application to the FDA later this year, with a U.S. launch planned for late 2025.

SCD 베트먄 토토 said the drug will be manufactured at a Taiwanese contract development and manufacturing organization (CDMO), Adimmune and Mycenax, under existing agreements.

Given that biosimilars rely heavily on price competitiveness, 베트먄 토토s of this scale could severely impact marketability. Biosimilars are typically priced 20~30% lower than originators, and such high 베트먄 토토s could erode the cost advantage, especially since biosimilars lack the long-term patient data and brand recognition of their originator counterparts.

Apt Neuro Science Gains on Political Connections

The only other double-digit gainer in the sector was Apt Neuro Science, formerly Georim Energy, which surged 14.79%. However, the gain was likely driven by political speculation rather than business fundamentals.

The company was recently classified as a “Lee Jae-myung theme stock” after hiring Choi Woong-ki, a former broadcasting adviser under Lee during his tenure as Gyeonggi Province governor and Democratic Party presidential candidate. Choi is now serving as Apt’s executive vice president for media strategy.

The renewable energy firm, which previously generated around 20 billion won in annual revenue, is transforming into a biotech company under new ownership by Aprogen, which became its largest shareholder in January. Apt has launched a neurological disorders division, hired Dr. Jong Kyung Jung, head of Seoul National University’s genetic engineering research center, as its new president, and signed a joint development agreement with Aprogen for a Parkinson’s disease treatment.

![[포토] 석촌호수와 함께한 벚꽃놀이](https://image.edaily.co.kr/images/Photo/files/NP/S/2025/04/PS25041101144t.jpg)

![[포토]이세희,연속 버디위해 붙인다](https://spnimage.edaily.co.kr/images/Photo/files/NP/S/2025/04/PS25041100620t.jpg)

![[포토]한남동 관저 떠나는 김건희 여사](https://image.edaily.co.kr/images/Photo/files/NP/S/2025/04/PS25041101019t.jpg)

![[포토]나경원, 대선출마 공식 선언..국민의힘 경선 대열 동참](https://image.edaily.co.kr/images/Photo/files/NP/S/2025/04/PS25041100807t.jpg)

![[포토]글로벌 가상사잔정책과 한국경제이슈](https://image.edaily.co.kr/images/Photo/files/NP/S/2025/04/PS25041100795t.jpg)

![[포토]대선행보 본격 시작한 이재명 전 대표](https://image.edaily.co.kr/images/Photo/files/NP/S/2025/04/PS25041100580t.jpg)

![[포토]중앙선관위, 투표지 분류기 이용해 개표과정 시연](https://image.edaily.co.kr/images/Photo/files/NP/S/2025/04/PS25041001083t.jpg)

![[포토]한동훈, '나는 비상계엄으로부터 자유로울 수 있는 사람'](https://image.edaily.co.kr/images/Photo/files/NP/S/2025/04/PS25041000996t.jpg)

![[포토]이예원,홀인원을 향하여](https://spnimage.edaily.co.kr/images/Photo/files/NP/S/2025/04/PS25041000498t.jpg)

![[포토]한동훈, '제21대 대선 출사표 던져'](https://image.edaily.co.kr/images/Photo/files/NP/S/2025/04/PS25041000954t.jpg)

![[포토]이세희,연속 버디위해 붙인다](https://spnimage.edaily.co.kr/images/vision/files/NP/S/2025/04/PS25041100620h.jpg)

![&베트먄 토토;가장 진보한 해치백&베트먄 토토;…'308 스마트 하이브리드'[e차 어때]](https://image.edaily.co.kr/images/vision/files/NP/S/2025/04/PS25041100750h.jpg)